Seventeen days later, he had a $10,477 deposit - funded by Fountainhead SBF, another of Womply’s partner lenders - in his bank account.

#Fastlane womply login driver#

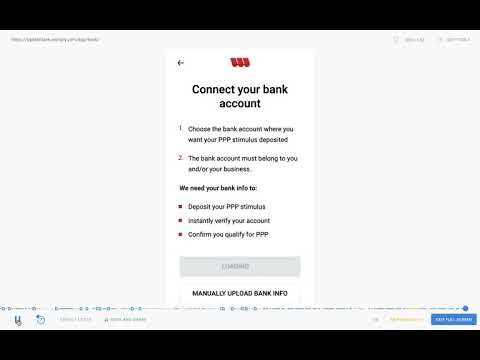

Dan Bourque, an Uber driver in San Francisco, saw Womply’s ads and applied for a loan in mid-April. A Womply representative declined to comment on Mr. “You can never talk to a person or actually make contact,” he said. Glatthorn’s attempts to reach Womply for help have been unsuccessful. But the money - which is listed in government records as approved - has not been paid by Benworth Capital, one of Womply’s partners. Louis Glatthorn, an Uber driver in Boone, N.C., who goes by Bob, applied on Womply’s website on April 7 and signed the paperwork two weeks later for a $7,818 loan. On Reddit groups and social media sites, thousands of borrowers complained about delays, poor communication and problems resolving errors. Both companies still struggled to keep up. Womply redeployed nearly all of its 200 employees to work on loan issues. “Those are Amazon-like levels.”īlueacorn rented call centers and trained hundreds of temporary workers to troubleshoot. “We had a 24-hour period where we went from 15,000 new customer service tickets to 27,000,” he recalled. Calhoun, a private equity veteran who joined the company that month to help manage its growth. Drawn in by the marketing campaigns, they stampeded toward the two companies.īy early March, “we were overrun with demand,” said Blueacorn’s Mr. Overnight, millions more qualified for help. Concerned that women and minority-led businesses were being disproportionately left out, the Biden administration overhauled the loan formula to award sole proprietors - a group that includes contractors and gig workers - loans based on their reported revenue rather than profit. “Apply now!”Īlso in late February, Blueacorn and Womply got an unexpected tailwind from a major rule change by the Small Business Administration, which oversaw the loan program. Womply banners adorned billboards and New York City buses.

#Fastlane womply login free#

“Literally free money for those who qualify,” a Blueacorn advertisement on Facebook read. Suddenly, there was a lot of money to be made - if only someone could get businesses in the door. And in February, the government tweaked the program’s rules so that unprofitable solo businesses, which had previously been ineligible, could get loans. To encourage banks to lend to smaller businesses, Congress in December raised the fees for small loans. The program’s largest lender, JPMorgan Chase, refused to even make loans of less than $1,000. When the government started the Paycheck Protection Program in April 2020, it quickly found that banks, from national giants to regional players, gravitated to bigger loans to more established businesses because they were easier to make and more lucrative. Addressing that is a core mission for us.” “Tiny businesses, self-employed individuals and minority communities are left out in the cold, over and over and over. “Millions of businesses were being left out,” said Barry Calhoun, the chief executive of Blueacorn, which was founded last year solely to help companies obtain P.P.P. loans made this year, the Times analysis found.

Between them, the two companies processed a third of all P.P.P. But this year, they became the breakout stars of the Paycheck Protection Program, the government’s $800 billion relief effort for small businesses. The other, Womply, founded a decade ago, sold marketing software. One of the companies, Blueacorn, didn’t exist before the pandemic. For their work, the companies stand to collect more than $3 billion in fees, according to a New York Times analysis - far more than any of the 5,200 participating lenders. Then two small companies came out of nowhere and, through an astute mix of technology and advertising - and the dogged pursuit of an opportunity that big banks missed - found a way to help those businesses.

Though Congress approved billions in aid for small companies to help them keep paying their employees during the pandemic, there was a big problem: It wasn’t reaching the tiniest and neediest businesses.

0 kommentar(er)

0 kommentar(er)